Wednesday, 8 October 2025

BUDGET 2026

Finance Minister Paschal Donohoe has presented Budget 2026, a €9.4 billion package focused on targeted spending, housing measures, and support for families and ...

Finance Minister Paschal Donohoe has presented Budget 2026, a €9.4 billion package focused on targeted spending, housing measures, and support for families and businesses. Unlike recent years, this budget contains no once-off cost-of-living payments such as double child benefits or electricity credits, signalling a shift toward longer-term, structural measures. Of the total package, €1.3 billion is devoted to taxation changes – €200 million less than last year – with the remaining funds focused on core spending priorities, particularly health, housing, and education. A €1 billion contingency reserve has been established to manage spending pressures and cover costs associated with Ireland’s upcoming EU Presidency.

TAXATION AND PERSONAL FINANCE

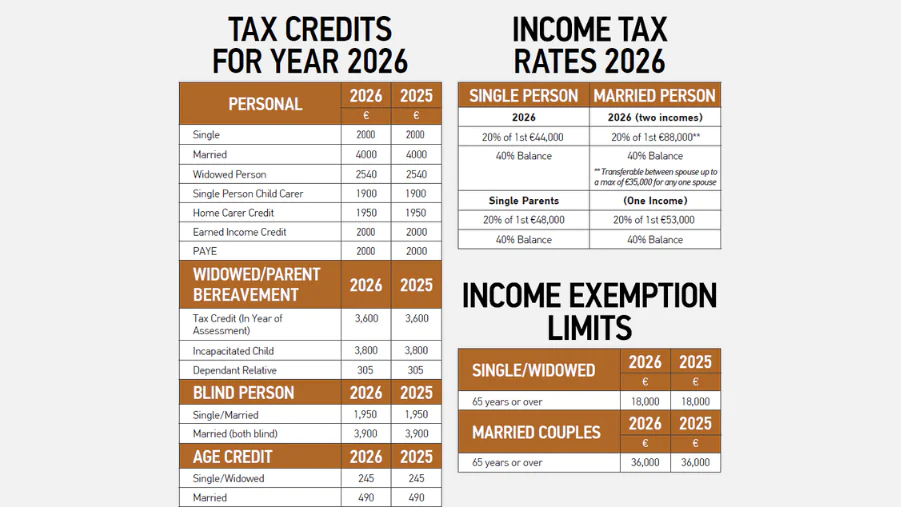

- Standard Rate Band:

The 20% income tax band remains at €44,000 for single earners and €88,000 for jointly assessed couples. - Tax Credits:

The personal, PAYE, and earned income tax credits remain unchanged at €2,000 each. The Home Carer Credit also stays at €1,950, and the Single Person Child Carer Credit remains at €1,900.

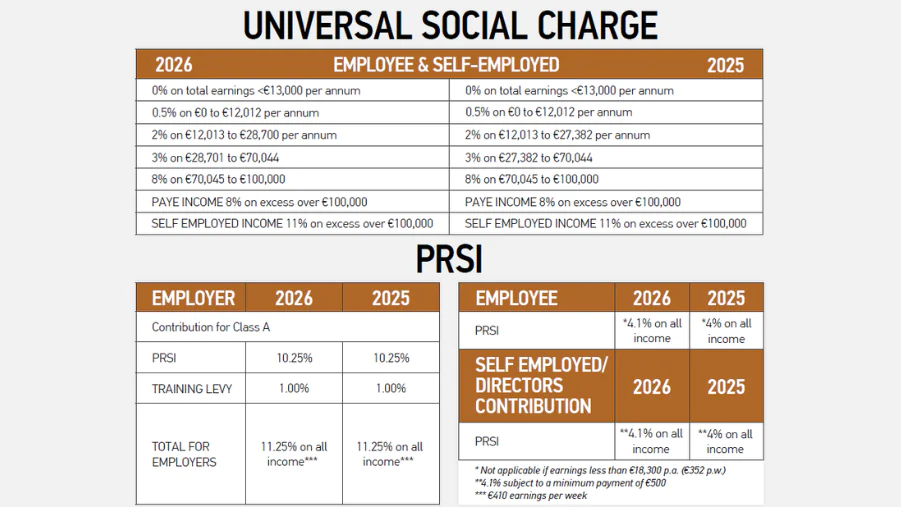

- Universal Social Charge (USC):

USC rates are maintained at 0.5%, 2%, 3%, 8%, and 11% for higher earners, with no major changes this year. - PRSI Contributions:

Employee PRSI remains at 4.1%, while employers continue to pay 10.25%, rising to 11.25% including training levies.

SOCIAL WELFARE & PENSIONS

- Core weekly social welfare payments – including the State Pension – will rise by €10 per week. - A Christmas Bonus will be retained for all eligible recipients.

- Child Benefit increases by €8 per child under 12 and €16 per child aged 12 and over. - Fuel Allowance eligibility extends to Working Family Payment recipients, with income thresholds for the Working Family Payment itself rising by €60.

- Carer’s Allowance income disregard increases to €1,000 for singles and €2,000 for couples. - Disability spending is set to rise by €500–€600 million, supporting additional childcare and community inclusion measures.

- The Back-to-School Clothing and Footwear Allowance will be extended to cover children aged two and three.

HOUSING, RENTERS & MORTGAGE HOLDERS

Housing remains a top priority with significant investment and several tax-based incentives: - Help to Buy Scheme extended beyond 2026.

- Rent Tax Credit prolonged for another three years, remaining at €1,000 for individuals and €2,000 for jointly assessed couples. - Mortgage Interest Tax Relief extended for two more years, tapering to €1,250 in 2025 and €625 in 2026.

- VAT on new apartments cut from 13.5% to 9% to stimulate supply. - Corporation Tax exemptions/reductions introduced for profits from qualifying Cost Rental and affordable housing developments.

EDUCATION & CHILDCARE

- Launch of a new DEIS+ scheme targeting the most disadvantaged schools. - 860 new special education teachers and 1,700 additional SNAs to be recruited.

- Creation of an Education Therapy Service for direct support in special schools. - Increased funding across all primary and post-primary schools.

- Student contribution fees cut by €500, reducing them to €2,500 per year. - SUSI grant income thresholds rise by €5,000 to €120,000 per household.

- Funding for thousands of additional childcare places and pay improvements for early years educators.

ENERGY, CLIMATE & UTILITIES

- Carbon tax increases from €63.50 to €71 per tonne of CO₂ for all fuels. - Lower 9% VAT rate on electricity and gas extended until end-2028, providing medium-term energy cost stability.

- SEAI energy upgrade schemes receive €588 million, up €89 million on 2025, supporting residential and community retrofits. - Fuel costs will rise by over 2c per litre due to carbon tax adjustments.

TRANSPORT

- Reduced public transport fares maintained throughout 2026. - VRT relief of €5,000 for electric vehicles extended to end-2026.

- Benefit-in-kind (BIK) relief for company cars tapered: - €10,000 in 2026

- €5,000 in 2027

- €2,500 in 2028

- Abolished from 2029

BUSINESS, ENTERPRISE & EMPLOYMENT

- Hospitality VAT reduced from 13.5% to 9% from July 2026, benefiting restaurants, catering, and hairdressing sectors. - Minimum wage to rise by €0.65 to €14.15 per hour.- R&D tax credit increased from 30% to 35%, with the first-year payment threshold raised to €87,500 to support smaller innovation projects. - Entrepreneurial relief (CGT) lifetime limit lifted from €1 million to €1.5 million.

- Special Assignee Relief Programme (SARP) extended for five years; minimum qualifying income increased to €125,000. - Bank Levy renewed for another year with an expected yield of €200 million.

HEALTH & SOCIAL CARE

- The Health Budget rises to €27.3 billion, an increase of €1.5 billion. - Recruitment of 300 additional mental health professionals and 100 crisis clinicians, including placement in emergency departments for out-of-hours response.

- Crisis resolution teams and drop-in crisis cafés to launch nationwide. - Continued expansion of women’s health services, with emphasis on accessibility and prevention.

JUSTICE, DEFENCE & PUBLIC SAFETY

- Funding for up to 1,000 new Garda recruits in 2026. - Increased allocations for body cameras, youth diversion programmes, victim support, and domestic violence initiatives.

- Additional resources to improve immigration processing times. - Ongoing expansion of the Defence Forces, continuing the recruitment drive launched in 2025.

AGRICULTURE, ARTS & RURAL DEVELOPMENT

- Agriculture receives enhanced funding for the new TB Action Plan and improved supports for farmers. - Basic Income for Artists made a permanent scheme, ending its pilot phase.

- Section 481 film tax credit increased to 40% for productions between €1–10 million. - Digital Games Tax Credit extended to 2031. - Additional €10 million for sports, including €3 million for the FAI academy system.

- €33 million allocated to continue the National Broadband Plan, and €15 million provided to support An Post.

“OLD RELIABLES” & CONSUMER TAXES

- 50-cent increase in excise duty on a box of 20 cigarettes, with proportional increases across other tobacco products. - No changes to alcohol excise duties announced.

SUMMARY

Budget 2026 represents a measured, stability-focused financial plan aimed at supporting core public services and vulnerable groups while maintaining fiscal discipline. With major once-off supports phased out, the emphasis shifts to sustainable investment in housing, childcare, education, and climate action. Taxpayers and businesses alike will see incremental reliefs and targeted incentives, rather than sweeping tax cuts. Overall, this is a consolidation budget that balances economic prudence with continued social investment ahead of the EU Presidency year.

Please note that this Budget Briefing is merely a general guide and should not be used as a substitute for professional financial

advice. Decision-making should be based on sound professional advice, taking into account your individual circumstances.

While we have made every effort to ensure the accuracy of this Budget Briefing, we do not take any responsibility or liability

for any omissions or errors, losses or injuries caused.

Please note that this Budget Briefing is merely a general guide and should not be used as a substitute for professional financial

advice. Decision-making should be based on sound professional advice, taking into account your individual circumstances.

While we have made every effort to ensure the accuracy of this Budget Briefing, we do not take any responsibility or liability

for any omissions or errors, losses or injuries caused.

Stay up to date with the latest financial updates and expert advice from our leading accountancy firm.