News & Insights

Accounting Grants for Sporting Bodies in Ireland

Accounting grants for sporting bodies in Ireland are a vital support for clubs, federations, and non-profits. They help these organisations grow sustainably and meet compliance standards. For many organisations, managing finances correctly is not just best practice: it’s a grant requirement. As an experienced Dublin accounting firm, we help sporting bodies secure funding and stay […]

What is a Chart of Accounts? Explanation & Examples

What is a chart of accounts? It is a structured listing of all the financial accounts used by a business to record transactions and organise its finances. A well-designed chart of accounts supports clear financial reporting. It also helps ensure tax compliance and informed decision-making. For businesses in Ireland, this tool is a foundational element […]

Audit vs Assurance: What Is the Difference?

When it comes to financial accuracy and trust, it’s important to understand audit vs assurance. Many people use these terms interchangeably, but they refer to different processes. At Cronin & Co, we offer trusted audit and assurance services to support businesses of all sizes. What is an Audit? An audit is a detailed check […]

Exporting goods from Ireland? How to Stay Compliant

Exporting goods from Ireland can be a valuable way to grow your business. However, it requires full compliance with tax, customs, and regulatory obligations. As an experienced accountancy firm, we work with businesses to ensure their operations run smoothly. This includes everything from customs documentation to tax planning. Whether you’re starting out or expanding to […]

Social Security Tax in Ireland: Everything an Employer Needs to Know

Social security tax is a key responsibility for employers in Ireland. It impacts payroll, compliance, and long-term workforce planning. If you operate a business, understanding your obligations is essential. It’s equally important to see how these align with your overall taxation responsibilities. Our firm offers professional taxation services to support your payroll and employer contributions. […]

Contribution Margin for E-Commerce Explained

For ecommerce businesses, understanding the contribution margin is crucial. This metric reveals how much revenue remains after covering variable costs. It also helps with pricing decisions and profitability analysis. As an accounting firm in Dublin, we help businesses gain insights into their finances and make informed decisions. In this blog, we’ll break down what contribution […]

How To Create an Attractive Remuneration Package?

An attractive remuneration package is essential for businesses. It helps attract and retain top talent in today’s competitive market. At Cronin & Co, we know how important fair and effective pay strategies are. Understanding the Components Designing an attractive remuneration package involves more than just salary. It encompasses various elements that collectively enhance the […]

How to Close a Limited Company in Ireland?

Closing a limited company in Ireland can be a complicated process. But, with the right guidance, it can be managed effectively. If you need to close a limited company in Ireland, understanding the process is crucial. This could be due to financial difficulties, a shift in business direction, or simply the decision to cease operations. […]

How to Claim Home Office Expenses with WFH Allowance

If you’ve been working remotely, you may wonder how to claim home office expenses to help cover your household costs. From electricity to broadband, remote working can come with additional out-of-pocket spending. Many people are unaware of the tax reliefs available to them. This is where professional taxation services can help you claim correctly and […]

Trump’s Tariffs: What Do They Mean for Businesses in Ireland?

Trump’s tariffs are making headlines, with new 20% duties announced on goods imported from the EU. For Irish businesses trading with the U.S., these tariffs have serious implications. That’s why understanding their impact is crucial. An experienced accountancy firm can guide you through these changing rules with clarity. A New Trade Barrier for Irish […]

How to Set Up Payroll: Best Practices

Managing payroll correctly is essential for any business. It ensures employees are paid accurately and on time. Understanding how to set up payroll ensures tax compliance and streamlines financial processes. Whether you’re hiring your first employee or scaling a business, following best practices can save time and reduce errors. For added efficiency, many companies use […]

How to Register an E-commerce Business in Ireland?

Starting a business in Ireland can be a rewarding venture. But, before you can start selling online, it’s essential to register your e-commerce business. Knowing how to register an e-commerce business ensures you comply with legal and tax requirements. It also sets a solid foundation for your business operations. Whether starting small or scaling up, […]

Cyber Security Tips for Small Businesses

In today’s digital world, cyber threats to businesses are at an all-time high. Using cyber security tips for small businesses helps prevent data breaches and financial loss. Businesses are frequent targets for cybercriminals. This is why it is essential to take proactive security measures. Seeking expert business advisory services can provide tailored strategies. These strategies […]

Choosing a Business Structure – Factors to Consider

When starting a business, one of the most critical decisions is choosing a business structure that suits your needs. Your choice will impact legal liability, tax obligations, and administrative requirements. Whether you are a startup, or growing enterprise, choosing the right business structure is essential. It ensures efficiency and financial stability. Seeking professional guidance, such […]

We’ve Been Shortlisted for Tax Team of the Year at the Irish Accountancy Awards 2025

We are delighted to share that our firm has been shortlisted for Tax Team of the Year at the Irish Accountancy Awards 2025. This recognition means a lot to us and is a reflection of the hard work, dedication, and expertise of our tax team. A Proud Moment for Our Tax Team The Irish […]

How to Become a Freelancer in Ireland

Freelancing is becoming an increasingly popular career choice. It offers flexibility, independence, and the potential for higher earnings. If you are wondering how to become a freelancer in Ireland, there are key steps to follow for a smooth transition. From registering your business to managing taxes, understanding the process is essential. We assist freelancers with […]

Special Assignee Relief Programme (SARP)

The Special Assignee Relief Programme (SARP) is designed to encourage skilled workers to relocate to Ireland. It offers tax relief for qualifying employees who move to Ireland to work for a connected company. As regulations around SARP change, it is crucial for businesses to stay informed. As a trusted provider of taxation services, we help […]

Influencer Accounting

Influencer accounting is essential for creators managing brand deals, sponsorships, and online earnings. With growing regulations, influencers must stay on top of their tax obligations. As an accounting firm in Dublin, we help influencers stay tax compliant. We ensure they report income from collaborations, gifts, and sponsorships correctly. In this article, we cover tax obligations […]

ESG Accounting – Reporting Requirements in Ireland

ESG Accounting is becoming more important for businesses in Ireland. This refers to tracking and reporting on a company’s environmental, social, and governance (ESG) activities. As regulations around sustainability grow, businesses need to follow ESG accounting standards. In this article, we will explain what ESG accounting is, what businesses need to report, and how to […]

The Residential Zone Land Tax

The Residential Zone Land Tax is a relatively new tax introduced in Ireland. It is aimed at encouraging the development of zoned land for housing. This tax applies to land located within residentially zoned areas that are not being developed on or used for residential purposes. The main goal is to address the housing shortage […]

OSS and IOSS VAT Returns for Irish Businesses

If you run a business in Ireland and are navigating OSS VAT Returns, understanding VAT (Value Added Tax) can feel overwhelming. Thankfully, the EU has introduced two systems, the OSS (One Stop Shop) and IOSS (Import One Stop Shop), to make things easier. These systems help businesses manage VAT more simply when selling to other […]

Register of Beneficial Ownership: Filing Requirements & Compliance

In Ireland, the Register of Beneficial Ownership (RBO) plays a critical role in improving transparency. It requires companies and legal entities to disclose information about individuals who own or control them. This initiative is part of broader efforts to combat financial crimes. These include money laundering and terrorist financing. Effective management of these requirements often […]

What Happens If I Miss a Tax Return Deadline?

What happens if I miss a Tax return deadline? Missing the deadline can lead to financial penalties and compliance issues. However, with prompt action and the right steps, you can navigate these challenges effectively. Addressing a missed tax deadline promptly is essential. It helps in reducing potential penalties. By taking action, you can ensure your […]

Members Voluntary Liquidation (MVL)

A member’s voluntary liquidation (MVL) allows solvent companies to close down and distribute their remaining assets to shareholders. This structured process ensures legal compliance while providing clarity for directors and stakeholders. Understanding the steps involved in the members’ voluntary liquidation process is key to ensuring a smooth and hassle-free transition. Support from a trusted company […]

Company Valuation: Key Steps to Maximise Your Business’s Worth

Understanding your company’s value is crucial for growth, investment, or planning an exit. A company valuation provides insight into your business’s worth. In turn, this helps you to make informed decisions. Whether you are a startup preparing for funding or a seasoned entrepreneur, maximising your company’s valuation is essential for long-term success. As a trusted […]

Business Exit Planning & Strategy for Small to Mid-Size Companies

Creating a robust business exit strategy is one of the most important steps for any business owner looking to step away from their company. An exit strategy not only ensures you can sell or transfer your company smoothly but also protects the value you have worked hard to build. Whether you are planning for retirement, […]

Dropshipping Accounting: What You Need to Know

Dropshipping has become a popular business model for entrepreneurs. It offers a low-cost way to enter e-commerce. However, mastering dropshipping accounting is crucial to ensure your financial records are accurate. In addition, you must ensure compliance with tax regulations. From managing inventory costs to understanding VAT obligations, this article explores the essentials of dropshipping accounting. […]

The Vacant Home Tax in Ireland

The vacant home tax is a measure introduced in Ireland to address the growing housing crisis. It is aimed at encouraging property owners to make better use of residential properties. This tax applies to homes that are left vacant for the majority of the year. Understanding how the vacant home tax works is essential for […]

Nursing Home Fees Tax Relief

Paying for nursing home care can be a significant financial burden for many families. Fortunately, nursing home fees tax relief provides some relief to help alleviate the cost of care. This tax relief is available to individuals who are paying for nursing home care for themselves or a dependent relative. It allows you to claim […]

Key Employee Engagement Programme (KEEP)

The Key Employee Engagement Programme (KEEP) is a tax-efficient share option scheme. It is aimed at helping Irish companies attract, retain, and motivate talented employees. KEEP provides eligible employees with share options. This allows them to participate in the company’s growth while reducing tax liabilities. It offers a tax-efficient means of rewarding team members without […]

Payroll for Independent Contractors in Ireland

Managing payroll for independent contractors in Ireland can be a complex task. Especially with varying regulations and compliance requirements. Independent contractors are self-employed people who provide business services without being on the company’s payroll. However, businesses still need to ensure that they handle payments accurately and in line with Irish tax laws. Many companies opt […]

Irish Capital Gains Tax (CGT) on Shares

Navigating Irish capital gains tax on shares can be complex for investors. Capital gains tax (CGT) is levied on the profit when you sell shares at a price higher than the purchase price, to tax financial gains. Understanding how CGT works, when it applies, and how is calculated is essential for anyone with an investment […]

Raising Capital for Your Business with Equity Crowdfunding

Raising capital for new business is one of the most crucial tasks for any entrepreneur. This is particularly true in today’s competitive market. A successful strategy for raising capital for a business can make the difference between growth and stagnation. One popular method for securing funding is equity crowdfunding. This enables businesses to attract investments […]

7 Things to Check Before the Financial Year-End

The financial year-end is a crucial time for businesses. It provides an opportunity to ensure everything is in order for tax submissions, reporting, and future planning. Proper preparation can prevent costly errors and ensure compliance with local regulations. As a trusted provider of taxation services, we’re here to help you streamline your processes. In this […]

Budget 2025

The coalition has made its multi-billion-euro pitch to voters ahead of the general election, with an €8.3bn Budget comprising €1.4bn in tax cuts and €6.9bn in new spending for 2025. Finance Minister Jack Chambers said the changes to personal income taxes would support low and middle-income earners. A range of tax changes and one-off measures […]

Company Seal Requirements in Ireland

Understanding company seal requirements in Ireland is crucial for any business operating within the country. A company seal, also known as a common seal, is a tool used to emboss legal documents. The seal signifies the company’s approval and the binding nature of the document. For many companies in Ireland, having a company seal is […]

Offering Equity in a Startup: Key Considerations for Founders and Investors

Offering equity in a startup is a crucial decision for founders looking to attract investment and drive growth. This process involves sharing ownership in the company in exchange for capital. It can significantly influence the business’s future and the dynamics between founders and investors. As a trusted accountancy firm in Dublin, we understand the essential […]

The Liquidation Process in Ireland

The liquidation process in Ireland is a legal procedure that involves closing a company and distributing its assets to creditors. It is typically initiated when a company becomes insolvent and can no longer meet its financial obligations. Understanding the steps involved in liquidation is essential for business owners who find themselves in this situation and […]

5 Common Financial Challenges Faced by Small Businesses

The financial challenges faced by small businesses are numerous and can significantly impact their growth and sustainability. Understanding these challenges is crucial for business owners who want to navigate obstacles and achieve long-term success. In this article, we will explore some of the most common financial challenges in business and how to address them. For […]

What To Do If You Receive a Tax Audit Notice

Receiving an audit notice can be unsettling for any business. Understanding the process and knowing how to respond can help ease your concerns. An audit notice from the Revenue is a formal request to review your financial records and ensure compliance with tax laws. In this article, we will outline the steps to take if […]

What to Expect During a Business Financial Review

A business financial review is a crucial process that helps companies assess their financial health and identify areas for improvement. As an established accounting firm in Dublin, we understand the importance of this process. Whether you are a small business owner or managing a larger enterprise, understanding what to expect can help you make informed […]

Auto Enrolment Pension Scheme Ireland

Auto-enrolment pension schemes are a pivotal step in ensuring financial security for employees in Ireland. This scheme automatically enrols eligible employees into a pension plan and promotes savings for retirement. As an experienced accountancy firm, we understand the importance of auto-enrolment becoming a reality in Ireland. Businesses and employees should grasp its implications, benefits, and […]

Determining Employment Status for Tax Purposes: The Karshan Case

At Cronin & Company, a trusted accountancy firm in Dublin, we understand the complexities involved in determining employment status for tax purposes. On 21 May 2024, Revenue issued new guidance following the Supreme Court judgement in ‘The Revenue Commissioners v Karshan (Midlands) Ltd. t/a Domino’s Pizza’ (‘Karshan case’). This case focused on the tax treatment […]

Research And Development Tax Credit in Ireland

Understanding the research and development tax credit in Ireland offers is crucial for businesses aiming to innovate and grow. This tax incentive encourages companies to invest in R&D activities by providing tax relief. As a leading accountancy firm in Dublin, we will explore the benefits, eligibility criteria, and how to maximise your R&D tax credit […]

Understanding The Corporate Tax Rate for Businesses in Ireland

Understanding the corporate tax rate is essential for businesses operating in Ireland. The corporate tax rate directly impacts a company’s financial planning and overall profitability. As a trusted provider of business advisory services, we want to aid businesses in understanding the Irish tax landscape. In this article, we will explore the corporate tax rate and […]

The Advantages of Incorporating a Business in Ireland

Incorporating a business in Ireland offers numerous advantages. It is an attractive destination for entrepreneurs and companies looking to expand their operations. From favourable tax rates to a skilled workforce, Ireland provides a supportive environment for growth. In this article, we will explore the benefits of incorporating a business here. Additionally, we will provide insights […]

Common Accounting Mistakes to Avoid for Irish SMEs

Common accounting mistakes have serious impacts on the financial health of Irish SMEs. These errors can lead to cash flow problems, inaccurate reporting, and compliance issues. As a trusted accounting firm, we are here to help small and medium-sized enterprises (SMEs) navigate the complexities of accounting. In this article, we will explore the most common […]

Tax-Deductible Expenses in Ireland

Understanding tax-deductible expenses in Ireland is crucial for businesses and self-employed individuals. Accurately tracking these expenses can significantly reduce your tax liability, helping you save money and reinvest in your operations. As a trusted provider of taxation services in Ireland, we will explore various tax-deductible expenses. Continue reading for insights into what can be claimed […]

Share-Based Remuneration

Share-based remuneration is an increasingly popular method for companies to reward their employees. This form of compensation involves giving employees shares in the company. In turn, this will align employees interests with those of shareholders. As a trusted provider of payroll services in Ireland, Cronin & Co understands the importance of grasping how share-based remuneration […]

Bookkeeping For E-commerce Business

Bookkeeping for e-commerce businesses is essential to ensure financial stability and growth. As e-commerce continues to grow, managing your finances accurately is crucial. Effective bookkeeping helps online businesses track their income, expenses, and profitability. This simplifies making informed decisions and staying compliant with tax regulations. As a bookkeeping services provider, we understand the importance of […]

Bookkeeping For Solicitors & Law Firms

Legal work demands meticulous financial management. Bookkeeping for solicitors & law firms ensures precision and adherence to regulations. It is important for handling financial transactions. At Cronin & Co, we specialise in providing tailored bookkeeping services for legal professionals. Why Bookkeeping Services Matters for Law Firms In the legal sector, financial transactions are diverse […]

How to Avoid and Reduce Employee Burnout

In today’s workplace, understanding how to avoid employee burnout is essential. Prolonged exposure to work-related stressors can lead to exhaustion, cynicism, and reduced efficacy. Stress is a normal part of any job, but chronic exposure to high levels of stress without adequate recovery time can lead to burnout. As a leading accountancy firm, Cronin & […]

Accounting For Tech Companies and Start-Ups

In the fast-paced world of technology, efficient financial management is essential. Accounting for tech companies involves unique challenges and opportunities that differ significantly from other industries. As a trusted firm offering bookkeeping services, we help startups and well-established tech firms navigate these differences. Understanding these financial nuances is crucial for success. In this article, we […]

Bookkeeping For Real Estate Agents

Effective financial management is crucial for success in the real estate industry. Bookkeeping for real estate agents is essential for maintaining accurate financial records and ensuring compliance with industry regulations. As a trusted provider of bookkeeping services, Cronin & Co. helps realtors in Ireland manage their finances efficiently and accurately. In this article, we provide […]

Healthcare Accounting and Bookkeeping

For healthcare professionals, managing finances is a critical task. That is where healthcare accounting services step in to provide essential support. Healthcare providers, whether individual practitioners or large organisations, rely on these services. They depend on them to navigate the landscape of financial regulations and reporting requirements efficiently. Partnering with a trusted brand like Cronin […]

Bookkeeping For Contractors and Construction Companies

Effective bookkeeping services are essential for contractors, tradesmen, and builders to manage finances. As a trusted provider of bookkeeping services, we understand the unique needs of these businesses. Let us explore the basics of bookkeeping for construction companies. In particular, we will focus on simplicity and practicality. Understanding Bookkeeping for Contractors Bookkeeping for contractors […]

Retirement Relief Ireland: Qualifying Conditions

Understanding retirement relief in Ireland is essential for individuals contemplating the sale of their business or farm assets. Despite its name, retirement relief isn’t exclusively for retirees. In this guide, we’ll delve into the qualifying conditions for retirement relief in Ireland, shedding light on who’s eligible and what it entails. As your trusted accountancy firm, […]

Double Materiality

In sustainability reporting, double materiality is key for businesses addressing ESG (environmental, social and governance) risks and opportunities. It connects internal operations with external impacts, aligning with the goals of the Corporate Sustainability Reporting Directive (CSRD). As a trusted provider of business advisory services, we’ll delve into what double materiality means for modern businesses. […]

Salary Sacrifice: Arrangements and Examples

In the world of employee benefits, salary sacrifice has become a valuable tool for employers. This approach lets employees exchange part of their salary for specific benefits offered by their employer. In turn, they will receive financial perks and tax advantages. In this article, we will explore salary sacrifice, how it works, and the schemes […]

Asset Management and Valuation Ireland

In recent years, Ireland’s asset management sector has experienced substantial growth. The net asset values (NAVs) of Irish domiciled funds soared from €1,055bn in 2011 to a record-breaking €4,082bn in 2023. The significant growth in Ireland’s asset management industry is thanks to external factors like prolonged low interest rates after the global financial crisis. Ireland’s […]

Compassionate Leave in Ireland: Entitlement & Policy

Compassionate leave in Ireland is a vital aspect of work-life balance. It recognises that employees may require time away from work due to personal circumstances. In today’s fast-paced and demanding work environment, it is easy to get caught up in the daily grind and forget that employees have lives outside of work. As a leading […]

Redundancy Entitlements and Pay in Ireland

In Ireland, understanding redundancy entitlements and pay is crucial for employees and employers alike. Redundancy occurs when an employer reduces staff numbers or closes a business, leading to job loss for employees. As a leading accountancy firm, we have put together this article to delve into the intricacies of redundancy entitlements in Ireland. To learn […]

Corporate Social Responsibility (CSR) in Ireland: Meaning & Examples

In the world of business, corporate social responsibility in Ireland (CSR) is essential. It involves businesses voluntarily taking actions to benefit society and the environment. This usually goes beyond making profits. As a leading accountancy firm in Dublin, we understand the importance of CSR in building a better future. In this article, we will explore […]

Financial And Non-Financial Rewards for Employees

Financial and non-financial rewards for employees are important elements in creating a motivated and engaged workforce, essential for the success of any business. As a leading accountancy firm in Dublin, we understand the significance of offering enticing incentives to attract and retain top talent. In this article, we will delve into the importance of both […]

Mortgage Interest Tax Credit

In response to the Finance Bill 2023, a new Mortgage Interest Tax Credit initiative has emerged, providing a one-year relief for homeowners with eligible loans on their primary residence. In this article, we will explore the intricacies of the mortgage interest relief scheme and how we can assist you in maximising its benefits. Qualifying […]

Tax Relief for Landlords

In the landscape of property ownership in Ireland, understanding tax relief for landlords is pivotal. Being a landlord comes with financial responsibilities and obligations, and ensuring compliance and maximising returns is vital. From claiming tax relief on rental property to comprehending landlord interest relief and income tax relief, this guide explains key aspects that can […]

Accounting Standards for The Hospitality Industry

When it comes to accounting for the hospitality industry, having a firm grasp of its standards is essential. In this sector, precision and following specific accounting standards are vital. To ensure accurate reporting and adherence to legal requirements, the hospitality industry must observe appropriate accounting guidelines. As a top accountancy firm, we understand the unique […]

Increased Cost of Business Grant Scheme

In a recent announcement, Minister for Enterprise, Trade, and Employment Simon Coveney revealed significant support for businesses facing increased costs through the Increased Cost of Business (ICOB) grant. This financial boost, totalling €257 million, is a crucial initiative outlined in Budget 2024. As a leading accountancy firm, we understand the challenges businesses face, and we […]

The Difference Between Class S PRSI and Class A PRSI

Understanding the difference between Class S PRSI and Class A PRSI is crucial for individuals venturing into self-employment. As a leading accountancy firm in Ireland, we emphasise the importance of comprehending the PRSI system. PRSI, or Pay-Related Social Insurance, is a mandatory contribution system in Ireland that funds social insurance (welfare) payments. Class A PRSI […]

Retail Business Accounting: Financial Solutions

Embarking on a successful retail journey involves not only showcasing products but also mastering the intricacies of retail business accounting. At Cronin & Co, we understand the pivotal role that precise financial solutions play in the retail industry. In this guide, we delve into the essentials of retail business accounting, offering insights and strategies to […]

Non-profit accounting in Ireland

Navigating the financial landscape of charities and not-for-profit organisations requires specialised expertise in non-profit accounting. As a respected accountancy firm, we recognise the distinct financial landscapes that these businesses must navigate. In this comprehensive guide, we will unravel the intricacies of not-for-profit accounting, shedding light on essential practices to ensure financial health and regulatory compliance. […]

Creating & Writing a Business Plan

Writing a business plan is a fundamental step for any aspiring entrepreneur or small business owner. It serves as a roadmap for your business’s future, outlining your goals, strategies, and the steps needed for success. Whether you are just starting your venture, seeking funding, or looking to drive your business to new heights, a well-crafted […]

Pension Advice for Small Business Owners

Pension advice for small business owners is vital to securing your financial future. Are you a small business owner seeking guidance on effectively planning and managing your retirement savings? As a business owner, you face unique challenges regarding retirement planning, and having the right pension advisor and business advisory support by your side can make […]

Tax-Free Vouchers for Staff in Ireland

In Ireland, tax-free vouchers for staff are a valuable benefit that employers can provide to their employees. Tax-free vouchers, often referred to as the Small Benefit Exemption, offer businesses an opportunity to show appreciation to their staff without incurring additional tax costs. As a leading Irish accountancy firm, we understand the significance of effective tax […]

Entrepreneur Tax Relief in Ireland

Entrepreneur Relief in Ireland is a financial incentive that can significantly benefit business owners and entrepreneurs. In this comprehensive guide, our expert accountancy firm in Dublin will delve into the details of this tax relief scheme, how it works, who is eligible, and provide valuable insights into real-world scenarios. Whether you are a seasoned entrepreneur […]

Budget 2024

On 10 October 2023, Minister Micheal McGrath and Paschal Donohue presented Budget 2024 to Dáil Eireann. Similar to Budget 2023, this budget has been designed to protect those most affected by inflation, and as a result this was primarily a cost-of-living budget. There was also a look to the future as the Minister […]

What is Capital Gains Tax?

What is Capital Gains Tax? If you’ve ever sold an asset such as property, stocks, or valuable possessions, you might be wondering about the financial implications of your sale. This is where Capital Gains Tax (CGT) comes into play. CGT is a tax on the profit you make when you sell an asset, and it […]

Understanding Director’s Loan Accounts

If you are a director or shareholder in a company, you might have come across the term “director’s loan.” This type of loan can serve various purposes in a business’s life, offering advantages and potential drawbacks. As a leading accountancy firm, we understand that managing finances within a company involves various complexities. In this guide, […]

Preliminary Tax in Ireland

Preliminary tax in Ireland is a crucial aspect of taxation that individuals and businesses need to understand. It is the tax you pay in advance of your final tax liability for the year. This payment ensures that you meet your tax obligations promptly and avoid penalties. Cronin & Co, your trusted partner in taxation services, […]

New Solicitors Accounts Regulations in Ireland 2023

In this informative guide, we will delve into the new solicitor’s accounts regulations that have come into effect in 2023. The legal profession in Ireland is no stranger to regulatory changes, and these updated rules significantly impact how solicitors manage their accounting and financial affairs. Our trusted accountancy firm is here to guide you through […]

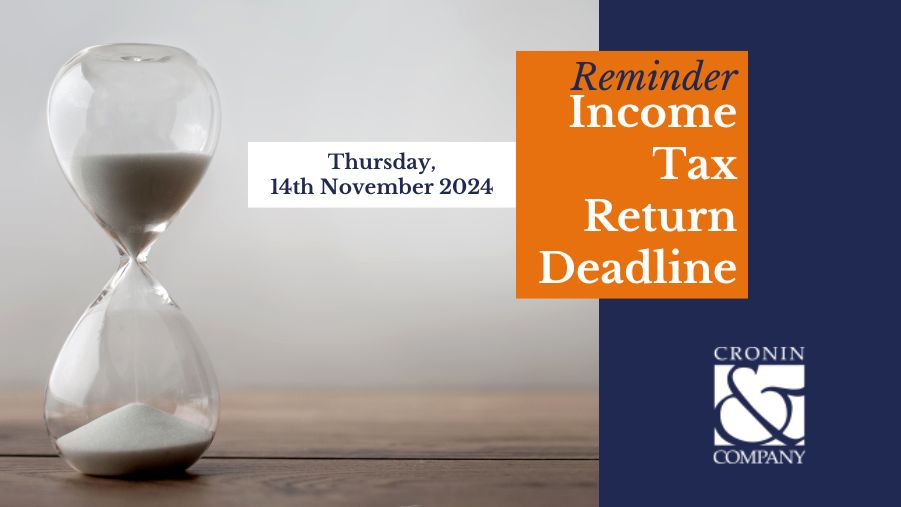

Income Tax Return Deadline 2024 in Ireland

The tax return deadline in Ireland is a critical date that every taxpayer should mark on their calendar. Filing your tax return on time is not just a legal obligation but also an opportunity to manage your finances efficiently. At Cronin & Co, we understand the importance of meeting the income tax filing deadline for […]

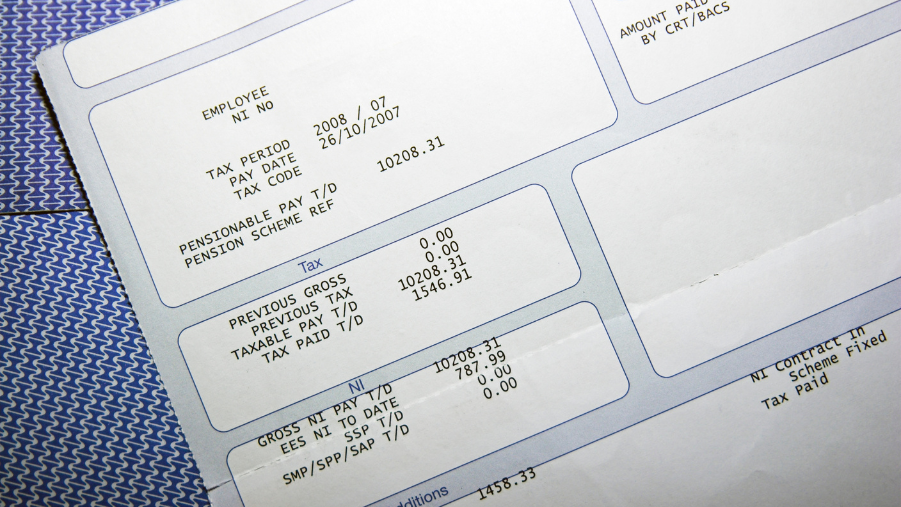

Enhanced Payroll Reporting Requirements in Ireland

Navigating the landscape of payroll reporting requirements is a business imperative. Recent developments in legislation have brought forth enhanced reporting requirements that employers must grasp. Effective 1 January 2024, the Finance Act 2022 introduced Section 897C, mandating payroll annual reporting, requiring employers to report specific payment details to Revenue. To ensure seamless compliance, it is […]

What Are Management Accounts?

What are management accounts? In the world of business, effective decision-making relies on accurate and insightful financial information. This is where management accounts come into play. As an established accountancy firm, we understand the significance of management accounts in providing businesses with the tools they need to navigate the complexities of finance. In this article, […]

Best Business Bank Account in Ireland: A Guide for Entrepreneurs

Are you a business owner in Ireland searching for the best business bank account that suits your needs? Then look no further. As a leading accountancy firm, we have put together this guide to explore the top business bank accounts in Ireland to help you make an informed decision. Managing your business finances is crucial […]

How to Register a Business Name in Ireland

If you are planning to start a business in Ireland, one of the recommended steps is to register your business name. Business name registration helps establish your brand identity in Ireland. In this guide, we as a leading accountancy firm in Ireland will walk you through the process of registering a business name, the requirements, […]

Pension Contributions Tax Relief Explained

As you plan for your retirement, understanding the benefits of pension contributions tax relief in Ireland becomes essential. At Cronin & Co, we recognise the importance of maximising your savings while optimising tax advantages. By leveraging pension tax relief, you can boost your retirement savings potential and reduce your tax liability. In this blog, we […]

The Buyback of Shares Explained

In this blog, we will delve into the intricacies of the buyback of shares, a crucial process that companies undertake. As a leading accountancy firm, we aim to demystify complex financial concepts. Whether you’re an investor, business owner, or simply interested in understanding this topic, we will explain the concept, and its implications, and provide […]

Your Taxation Must Be Right To Avoid A Revenue Investigation

Revenue collect all the tax they know is owed, but they also look at businesses and individuals to make sure they do not owe more tax because they are under declaring their income. Investigations are very profitable for the government, so they are not likely to stop them at any time in the future. In […]

The Home Carer Tax Credit in Ireland Explained

As a leading accountancy firm in Ireland, we recognise the significance of the Home Carer Tax Credit for individuals who provide care at home. This blog will delve into the eligibility criteria, application process, and real-life examples of how this tax credit can benefit home carers. Discover how you or your loved ones can maximise […]

Receivership in Ireland

Receivership is a legal process that plays a significant role in financial matters. In Ireland, receivership serves as a mechanism to manage various scenarios, including bankruptcy and financial distress. This article provides an in-depth exploration of receivership, its types, and its implications in Ireland. As a leading accountancy firm in Ireland, we understand the complexities […]

2023 Rates of Universal Social Charge (USC) in Ireland

The Universal Social Charge (USC) in Ireland plays a significant role in the country’s taxation system. It is essential for taxpayers to have a clear understanding of the USC, including the rates for 2023. As an established accountancy firm in Ireland, we understand the importance of navigating the intricacies of the tax system. In this […]

Airbnb Tax in Ireland Explained

Are you an Airbnb host seeking clarity on the tax due on their Airbnb income regulations in Ireland? In this comprehensive guide, we will explain the tax implications on your Airbnb income and provide you with a complete understanding of the requirements. From understanding how tax on your Airbnb income works in Ireland to filing […]

Average Take-Home Pay in Ireland

When considering a job offer or evaluating your financial situation, understanding your take-home pay is crucial. Knowing the average take-home pay in Ireland can provide valuable insights into your financial planning. This blog aims to explore the concept of average take-home pay in Ireland, providing an overview of calculations, factors influencing net income, and how […]

Work-Life Balance and Miscellaneous Provisions Bill – Updates Under the Act

The Work-Life Balance and Miscellaneous Provisions Bill has been introduced to address a prominent issue in Ireland. In today’s fast-paced world, achieving a healthy work-life balance is crucial for employee well-being and productivity. As one of the top accountancy firms in Dublin, we aim to provide a comprehensive overview of the Work-Life Balance act, its […]

How to Claim Emergency Tax Back Online in Ireland

If you have recently started a new job in Ireland and have been subjected to emergency tax, you may be wondering how to claim it back. In this guide, we will walk you through the process of claiming emergency tax back online in Ireland. The team at our accountancy firm understands the importance of navigating […]

Global Mobility News: Guidance for Irish and Foreign Employers from Revenue

Global mobility has become a significant aspect of the modern workforce, with employees frequently crossing borders for work assignments. In Ireland, both domestic and foreign employers need to stay updated on the latest regulations and guidelines to ensure compliance and effective management of their mobile workforce. The Irish Revenue has recently issued new guidance, providing […]

Employee Share Purchase Plans: A 5-Step Guide

Employee share purchase plans (ESPPs) offer a valuable opportunity for employees to become shareholders in their own company. As one of the top accountancy firms in Dublin, we understand the importance of fostering employee engagement and aligning their interests with the success of the organisation. These plans, also known as employee share ownership plans, provide […]

Tax Reimbursement – When to Claim Tax Back in Ireland?

Claiming tax back is a common process for many individuals in Ireland. It can help to reduce financial burden and increase disposable income. However, knowing when to claim tax back in Ireland can be confusing for many people. In this blog, we will explore the various scenarios when you can claim tax back in Ireland […]

New PPSN Disclosure Requirement for Company Directors

This article discusses the new PPSN disclosure requirements for Irish company directors, along with what they need to know to stay compliant. New PPSN Check for Directors in Ireland Starting from the 23rd of April 2023, all directors of Irish companies must disclose their PPSN to the Companies Registration Office (CRO). The objective of […]

Company Shareholders’ Agreement – Everything You Need to Know

What is a Shareholders’ Agreement? A shareholder’s agreement is a standard legally binding contract between shareholders of a company. It sets out the rules and regulations that the company and its shareholders must comply with. It ensures that all shareholders are on the same page and aware of their rights, responsibilities, and obligations. It also […]

Accounting Software for a Small Business in Ireland

Accounting software for small businesses in Ireland can help streamline and simplify financial processes, offering greater control and accuracy. In this article, we will be discussing the benefits that accounting software can provide to small businesses in Ireland, followed by some guidance on choosing the right software for your needs. What is Accounting Software? […]

Tax Incentives for Businesses in Ireland

For businesses in Ireland, there are several tax incentives that can help to make operating a business much more affordable. These tax incentives are designed to reduce the amount of tax payable, allowing businesses to invest more of their profits into growing their business. When it comes to setting up and running a business, one […]

Summary of the Finance Bill – 2023 Budget Ireland

The Irish Finance Bill 2023 was recently published by the Oireachtas on March 9th, which announced tax measures introduced in Ireland as part of this year’s budget and the Cost-of-Living package. Though concise, when compared with previous bills, these measures should help the country build a stronger and more competitive economy. It contains additional proposed […]

Latest Changes To BIK On A Company Car In Ireland 2023

The Irish government has introduced a tax relief of €10,000 to aid in reducing the amount of Benefit in Kind (BIK) payable on a company car in 2023. What Is Benefit in Kind (BIK)? Benefits-in-kind (BIK) refer to non-cash rewards that an employer may give to their employees, in addition to their usual salary […]

Irish Business Supports And Grants – Funding For Startups In Ireland

Want to know more about available funding for startups in Ireland? Starting a business is an exciting and challenging prospect for many entrepreneurs. With its modern infrastructure, talented workforce and welcoming environment, Ireland can be an attractive place to start and grow a successful business. However, like any venture, it’s not without its risks and […]

Why Companies Are Outsourcing Payroll In Ireland?

One of the most important elements of running any business is managing payroll. But this process can be complex and time-consuming. In today’s business landscape, companies must find ways to remain competitive and increase their efficiency. This often means finding ways to outsource services such as payroll. According to SD Worx, Ireland is one of […]

New Cost of Living Measures & Extension on Rates of VAT In Ireland

The cost of living in Ireland is rapidly increasing, and a new set of measures, including an extension on rates of VAT, have been announced by the Irish Government to tackle this issue. From household bills to essential grocery items, Irish people across the country are feeling the pinch of rising costs. Last week, Taoiseach […]

Digital Games Tax Credit: Everything You Need to Know

The introduction of a digital games tax credit has been welcomed by the gaming industry in Ireland. Keep reading to learn more about the tax credit and whether you may be eligible. Why was the digital games tax credit introduced? This tax relief was announced in Budget 2022 and enables companies that produce video […]

VAT Reverse Charge Explained – When and How It Operates in Ireland

VAT reverse charge: when and how does it operate in Ireland? Here’s everything you need to know! The “reverse charge” is a mechanism by which the responsibility for accounting for VAT is transferred from the seller to the buyer. It operates in three broad areas: -Intra-EU trade (including Northern Ireland) and imports from outside the […]

Setting up a limited company in Ireland

This step-by-step guide to setting up a limited (LTD) company in Ireland will explain how to register a limited company and it will highlight the cost of the set up process. This guide will ensure your company is set up correctly from the start. What is a limited company (LTD)? A limited company is […]

How To Claim The Rent Tax Credit For 2023

In December 2022, a significant development emerged for individuals contributing to private rented accommodation – the inception of the Rent Tax Credit. This tax credit, established by the Minister for Finance in Budget 2022, is poised to assist renters paying for private rented housing. The applicability of this tax credit extends from the year 2022 […]

What is the Short-Term Enterprise Allowance (STEA)?

The short-term enterprise allowance supports individuals who want to pursue self-employment after losing a job. You must be entitled to or availing of Jobseeker’s benefit to meet the eligibility criteria for the allowance. This STEA is paid for a maximum of 9 months in place of your Jobseeker benefits. The short-term enterprise allowance ends when […]

Christmas Opening Hours 2022

On behalf of all of us here at Cronin & Company, we would like to wish you a very Merry Christmas and a prosperous New Year. Our office hours over the Christmas period are as follows: Offices will close on Friday 23rd December. We will then re-open on Wednesday 4th January.

Tax on Christmas Gifts for Employees

As December approaches, you may be thinking about giving Christmas gifts to your employees. Gift cards and vouchers could be given without incurring taxes provided that they meet the criteria under the Small Benefit Exemption Scheme. There have been changes to the scheme announced in the Budget on 27th September 2022 A summary of the […]

National Minimum Wage Increases for 2023 and Beyond

The government announced in November 2022 that it wanted to launch a plan for the new national living wage to be introduced. The increases will begin from January 1st, 2023, and business owners need to consider this now to adjust payroll for the new year. The new minimum wage for people aged 20 and over […]

What is the Temporary Business Energy Support Scheme

€1.25 billion is being invested by the Irish government to help businesses cope with the rising energy costs. They will help businesses with their electricity and gas bills during the winter months when these costs are at an all-time high. The scheme is open to businesses that are tax compliant, that carry a case 1 […]

New Tipping Law Being Introduced December 1st 2022

A new tipping law is being introduced by the government which will be active by December 1 st, 2022. This new law will protect tips earned by workers, making it a legal entitlement and it will ensure even electronic tips would be paid to employees. It also makes it illegal for employers to use tips […]

Tax on Pension Contributions in Ireland

A pension is a long-term savings plan with tax relief helping to prepare a person for retirement. When you pay your pension contribution it is tax deductible meaning that you save a certain percentage of tax on your income depending on your age and the pension contribution made. Income Tax relief is given at your […]

6 Methods to Reduce your Tax in Ireland

If you are working in Ireland there are many ways to reduce the amount of tax you pay or different schemes that you may not be aware of that you claim tax back on. 1. Keep Medical Receipts An individual can claim a tax credit of 20% of unreimbursed eligible medical expenses and some non-routine […]

Tax on a Second Job in Ireland

Have you started a second job in Ireland or are you thinking about starting an extra job? If so, there are many things to consider when it comes to your tax and tax credits. Revenue counts one of your jobs as your primary employment and will allocate your tax credits and tax bands to that […]

When an Employee is Starting Employment for the First Time in Ireland

An employer with an employee who is starting their job for the first time in Ireland needs to make sure their employee has a PPS (Personal Public Service) number. If they do not have one, they need to be over the age of 18, be living in Ireland, have proof of address and identification such […]

What You Need to Know About The Budget 2023

On 27 September 2022, Finance Minister Paschal Donohoe presented Budget 2023 to Dáil Eireann. This budget has been designed to protect those most affected by inflation, and as a result this was primarily a cost-of-living budget. The budget introduced taxes and other measures to help curtail the effects of the current cost of […]

Debt Warehouse Scheme Period 2

The debt warehousing scheme was introduced to assist businesses who were struggling during the Covid 19 pandemic. With the scheme, it allowed businesses to defer paying tax liabilities until they were in a better position. The debt warehousing scheme operated as follows Period 1 ran from 1 July 2020 until 31 December 2021 which let […]

What to Consider when Setting up a Business in Ireland

Setting up a new business in Ireland can be a daunting task. There are many things to consider, and it is easy to get overwhelmed. This article will help you what to consider when starting your own business. Market Research Market research is very important to do at the beginning stages of starting a business. […]

What is the First Home Scheme and how does it work?

The first home scheme is a new initiative worth 400 million that will help home buyers with the purchase of a new home, where the government will cover up to 20% of the purchase price of the house for up to 20% equity in the house. This scheme helps people who can’t afford a house […]

Our Guide on the Back to Work Enterprise Allowance

The Back to Work Enterprise Allowance helps people on social welfare payments to become self-employed and start their own business. Within this scheme, you can keep 100% of your social welfare payment for the first year and 75% for the second year, for a maximum of two years. The Back to Work Enterprise Allowance (BTWEA) […]

Tax for Remote Workers working outside of Ireland

Because of the pandemic, working from home has become the norm for many employed within Ireland. Businesses allowed for workers to be situated abroad and work remotely. There are some tax considerations when doing this for the employer and employee. Long Term Relocation Irish workers pay taxes such as PRSI, USC, and Income tax using […]

New Code of Practice for Revenue Compliance Interventions

The new code of practice has been effective since 1st May 2022. The new code of practice for revenue compliance sets out a new framework for compliance interventions and will replace the old framework. Revenue aimed to create a better approach for allowing different levels of intervention to get better engagement with taxpayers. According to […]

What you need to know about the Statutory Sick Pay Scheme

Statutory sick pay is wages paid to an employee who is sick and unable to work. In Ireland it was not mandatory for a company to pay their employees while they were sick but in March the Irish government announced the statutory sick pay scheme which is rolling out this later in the year and […]

VIES and INTRASTAT Returns – Traders Obligations

VIES and INTRASTAT returns have commonly been disregarded by traders in the past. However, Revenue are cracking down on these returns, amongst others, more and more. While they do not generate any tax liabilities, the returns can affect a client’s tax clearance cert and their standing with Revenue in terms of the non-filing of returns […]

What Medical and Health relief can be claimed for?

Any individual can claim tax relief on the cost of medical and health expenses. The health expenses claimed for can be for you, for any family member, or in fact any individual. The main stipulation is that you have paid for these expenses yourself. Relief cannot be claimed for any amounts that you will receive, […]

Lower Irish VAT rate for the Hospitality sector extended until 2023

The lower Irish VAT rate for the Hospitality sector extended until 2023 Last month, the Irish Minister for Finance, Paschal Donohoe confirmed that The government has extended the lower VAT rate for the hospitality sector for another six months. The lower VAT rate for the sector which is set at 9%, will now stay in […]

New RTB Annual Registration Requirements for Landlords

The new legislation commencing on the 4th of April 2022 requires landlords to re-register their tenancies with the Residential Tenancies Board (RTB) every year. Landlords must now register tenancies annually Starting with 4 April 2022, all landlords are required to register a tenancy (or a licence in Student Specific Accommodation SSA) every year with the […]

The Importance of a Forensic Accountant

Why do you need a Forensic Accountant? Forensic accountants investigate allegations of fraud in the financial world. They are brought in to protect the best interests of a business. They conduct internal and external financial investigations to uncover if fraudulent activities took place in their organisation. Trained and experienced financial investigators are particularly important, they […]

What is Due Diligence

Due diligence is an investigation of the financial circumstances of a business or individual. Due diligence means “reasonable care”, which means that investors should do their research before investing in a business or joint venture. It is often used before a business is bought or before a business partnership starts. This process helps people make […]

Remote Working Relief 2022

Remote Working Relief 2022 The remote working relief is a tax deduction for employees working from home. If you are working from home part time on a hybrid basis or full-time and have an arrangement with your employer to-do so, you may be entitled to remote working relief. You can claim this tax relief at […]

New Updates On the Debt Warehousing Scheme

The debt warehousing scheme was introduced in 2020 during the COVID-19 pandemic to aid struggling businesses. This included companies experiencing a decrease in turnover or volume of orders. The scheme allowed businesses to defer some of their tax liabilities until they were able to pay them. Recently, the Minister for Finance announced a pivotal adjustment […]

Enterprise Ireland Business Grants

Enterprise Ireland is the state agency responsible for the development and growth of Irish enterprises in world markets. EI offers grants for Irish businesses to help them grow and expand. Below are some of the grants they offer. Business Financial Planning Grant The COVID-19 Business Financial Planning grant will provide a strategic intervention for […]

Registering a Trademark in Ireland

What is a trademark A trademark is a type of intellectual property such as a phrase, logos, words, or symbols etc. It distinguishes one company’s products or services from another, and legally identifies a company’s ownership of a brand. Such trademarks as names, ideas etc. are considered intellectual property, meaning it is a nonphysical property […]

Cronin and Co are Sponsoring Laura’s Artic Challenge

The Artic Challenge is a fundraiser by charity Debra Ireland, a charity that helps support families living with the rare and painful skin disease Epidermolysis Bullosa (EB) Epidermolysis bullosa (EB) is the name for a group of rare inherited skin disorders that cause the skin to become very fragile. Any trauma or friction to the […]

Setting up a new business in Ireland 2022

Setting up a new business can be stressful and there is a lot involved in doing so. In this article, we are going to go through some of the more important parts to consider if setting up a new business in 2022. Write a Business Plan A business plan is a document that outlines […]

Outsourcing your Payroll and Bookkeeping for new Businesses 2022

When you are running a business, you might find there is just never enough time in the day. You may also find that it can be difficult to build a team whose knowledge and expertise cover all aspects of your business needs. Accounting can be an area where, unless specifically trained, very few have the […]

Christmas Office Hours

On behalf of all of us here at Cronin & Company, we would like to wish you a very Merry Christmas and a prosperous New Year. Our office hours over the Christmas period are as follows: Offices will close on Thursday 23rd December. We will then re-open on Tuesday 4th January.

Small Benefit Exemption Scheme

There is a significant increase in the Small Benefit Exemption Scheme in 2025. These changes make the scheme more advantageous for employers in Ireland to reward their employees in a tax-efficient way. From 1st January 2025, businesses will have greater flexibility in how they can provide tax-free benefits. This is excellent news for both employers […]

Benefit in Kind – What is it and is it taxable?

What is Benefit in Kind? A Benefit in Kind (BIK) is a benefit that an employee receives that cannot be converted into cash but has a cash value. Examples include the provision of a company car, loans given at a special rate or provision of accommodation. Benefits (other than benefits-in-kind) would include vouchers, holidays, payment […]

The Employment Wage Subside Scheme

What the wage subsidy scheme entails and how to know when to cease it. Businesses and individuals alike are finding their feet again after a tumultuous and uncertain two years, there is no doubt we are finally seeing the light at the end of the tunnel however there are still hurdles to overcome. One big […]

The National Startup Awards 2021 | Deadline Extended

Are you a start up company in Ireland? If so, Cronin & Co would like to direct your attention to the National Startup Awards 2021. WHAT IS THE NATIONAL START UP AWARDS? If you were previously unaware of the National Start Up Awards, it is a leading national award program for start up companies […]

What is Forensic Accounting?

When do you need forensic accounting and what does it entail? What is forensic accounting? Forensic accountants may be hired if a business suspects theft, fraud, or embezzlement. This is a specialised form of accounting conducted by an expert in a particular field. A forensic accountant may even testify in court as an expert […]

Local Property Tax: Valuation deadline

Most homeowners will have received a letter from Revenue prompting them to determine the market value of their properties. After submitting the valuation, the online LPT system will confirm the new band for the Local Property Tax in which the property falls. The letter issued by Revenue will set out their estimated LPT liability which […]

Biggest Tax Changes in Budget 2022

Check out our comprehensive overview of the main tax announcements from Budget 2022 by Carl Donnely of Cronin & Company

Budget 2022 Tax Changes

On 12 October 2021, Finance Minister Paschal Donohoe presented Budget 2022 to Dáil Eireann. This budget was the first since the many COVID-19 related lockdowns and restrictions, which of course are not all removed as yet. This budget has been presented in order to invest in Ireland’s future, meet the needs of today while putting […]

Preparing your Income Tax Return for 2021

The time has come once again to start preparing your Income Tax Return for 2020, the return is due by 31 October 2022 or 17 November 2022 if you pay & file online through Ros. Because of the requirements of the Pay and File system, it is very much to your advantage to have your Return prepared […]

Recap: The benefits of outsourcing your payroll

Internal payroll can be incredibly demanding for businesses. Processing payroll is more than just collecting employees’ hours, calculating wages, and issuing payslips. There is a myriad of additional tasks that come into play when you are responsible for this task. While many people prefer to keep their payroll function internal because they feel it is […]

How to prepare for a Revenue Audit

The receipt of a Revenue Audit notification can be a stress inducing event for taxpayers in Ireland. While Revenue Audits are often met with negative connotations it is important to remember that with careful preparation and expert advice you can minimise worry. We have put together some key tips that can help you to sail […]

The New EWSS Eligibility Review Criteria

Employers need to act now to comply with new EWSS Eligibility Review criteria Revenue recently issued a press release and Guidelines on EWSS eligibility from 1 July 2021. There are changes to the assessment period used to determine eligibility for pay dates between 1 July and 31 December 2021. Crucially employers must complete a monthly […]

How Can Advisory Services Help Your Company?

Business advisory services aim to help organisations of all sizes identify their business strengths and overcome their weaknesses. In order to achieve growth and create structured business plans, experts provide logistical, financial guidance to help business owners develop and implement projects to achieve their forecasts. Many business owners are continually challenged to make executive decisions. These decisions could be related […]

EU Introduces New VAT Rules Effective From 1st July 2021

Background Until now, VAT rules within the EU meant that goods being imported into the EU from outside the EU (‘3rd Countries’) could avail of an exemption from VAT if the value of the goods being imported, including delivery and insurance, was below €22. It was believed that many suppliers undervalued the supply on the […]

Local Property Tax Amendments and Updates

Local Property Tax (LPT) is a self-assessed tax, charged on the market value of residential properties in the Irish state. Liable people must pay their LPT liabilities on an annual basis. On the 1st June 2021, the cabinet agreed to bring forward legislation that will propose new changes and ammendments to how the LPT currently […]

When to call a forensic accountant?

Forensic accounting is a specialised form of accounting that is conducted by an expert professional in the field. This practice can be used in many applications, and it consists of a wide array of activities. At Cronin and Company, we provide a professional and discreet forensic accounting service. To learn more, read below. What is forensic accounting? Forensic accounting utilises accounting, auditing, and investigative financial skills to conduct […]

Why should SMEs hire an accountant?

Owning a small business is a point of pride for many, however, running an SME can be time-consuming and difficult. When you run your own business, you are responsible for a myriad of tasks, this can be challenging, and it can put you under undue pressure and strain. To manage all your affairs as an […]

Tax Credit in respect of tax deducted from the emoluments of proprietary directors but not yet paid to Revenue – Section 997A TCA 199

Under Section 997A TCA 1997; if an employer is availing of debt warehousing for PAYE (employer) liabilities, a proprietary director cannot claim a credit for PAYE deducted if it has been warehoused and not paid to Revenue. However, if the director or employee is eligible for income tax warehousing, she/he can warehouse all liabilities including […]

Outdoor Seating and Accessories for Tourism and Hospitality Services Support

At long last, we have received news that the Tourism and Hospitality industries are reopening. It has been a considerable amount of time since the tourism industry has been buzzing with life. The current easing of restrictions is only allowing restaurants and bars to open for outdoor dining. To assist with this reopening, the government […]

How to prepare for a Revenue audit

An unexpected Revenue Audit is something that often brings fear to many business owners. If you own an SME and do not have an in-house finance team you might feel uneasy about the preparation. While it is natural to feel a bit overwhelmed after the news of a Revenue Audit, with careful preparation and expert […]

Why should you outsource your bookkeeping?

If you are the owner of an SME, it might be common for your day to go in multiple different directions. Between managing your employees, analysing your finances, paying bills and making decisions your time might feel stretched. Unfortunately, there never seems to be enough time when you are running a business. You can outsource […]

Why should you invest in advisory services?

The success of any business is often dependent on how strategically it manages its finances. Business advisory services involves having coherent goals and developing a strategy on how to help you move through different business processes easily. Accountants have the skills and experience to offer sound financial advice. When it comes to taxes, loans, mergers, […]

SBASC grants available for small businesses

The Department of Enterprise Trade & Employment has recently launched the Small Business Assistance Scheme for COVID (SBASC). SBASC gives grants to businesses who are not eligible for the Government’s COVID Restrictions Support Scheme (CRSS), the Fáilte Ireland Business Continuity grant or other direct sectoral grant schemes. This scheme aims to help businesses with their […]

What is forensic accounting and why is it important?

Forensic accounting is the speciality practice of accounting which investigates whether individuals or organisations have engaged in financial reporting misconduct. Forensic accountants apply a range of skills and methods to determine whether this misconduct has taken place. Forensic accounting utilises accounting, auditing, and investigative skills to conduct an examination into the finances in question. It essentially provides an accounting […]

Why should you outsource your payroll?

Some businesses both small and large opt to handle payroll functions internally or ‘in-house’ this is often done through manual bookkeeping or through assistive software. Other business owners however opt for outsourced payroll services. Outsourcing your payroll essentially means hiring the expertise of professional payroll provider to take responsibility for your payroll. When it comes to the pros and cons of in-house vs outsourcing, lots of […]

Due diligence as a service: An overview

Due diligence is an investigation, review or audit which is performed in order to confirm the facts of a matter under consideration. Due diligence requires an examination of financial records before entering a proposed transaction with another party. It is commonly used during an external audit. Small businesses may go through a due diligence process […]

Spotlight: The EWSS and what you need to know

Covid-19 has left its mark on almost every industry imaginable. Across Ireland, the effects of the pandemic have reaped havoc on profits, turnover and the day to day running of organisations. Last week, we outlined a variety of government supports that were available for businesses in Ireland at this time. This week however, we’re going […]

Brexit: The consequences of dealing with Mainland UK.

So, we are just over one month post Brexit. Undoubtedly, many of you have experienced delays in receiving products/goods coming from the UK, both personally and professionally, due to the delays at both the UK and Irish ports. But what are the final VAT consequences from trading with the UK, now that everything has settled […]

A summary of the Covid-19 supports available.

Businesses all over Ireland have been profoundly impacted since the Covid-19 virus landed on Irish shores. With reduced footfall, reduced profits and reduced disposable income, businesses in Ireland have been undoubtedly feeling the pinch. It is vital that companies continue to manage and mitigate the disruption being caused by Covid-19 where possible. To do so, […]

Budget 2020 – Taxation issues

It’s no secret that Budget 2020 would not be a give-away budget. The threat of a no-deal Brexit has obviously cast a dark shadow in the lead up to the Budget and has curtailed any expectations that Budget 2020 was going to line our pockets with cash. The following are the main taxation provisions that […]

The Register of Beneficial Ownership of Companies

Background The Register of Beneficial Ownership of Companies and Industrial and Provident Societies (RBO) was signed into law by the Minister of Finance on the 22nd March 2019. The legislation requires companies to file correct and current information on the beneficial owners of that company – which means any person or persons who directly or […]

Thinking of hiring? You might qualify for JobsPlus

Jobsplus is a government scheme where you can claim tax-free payments, for hiring a person, who has been on the live register for long periods. It is available to all employers in the private sector. You can claim between €7,500 and €10,000 back over a 2 year period. The payment levels are: – Under 25 […]

Tax Considerations for Employer Paying your Rent

Tax Considerations for when your employer pays you rent It is no secret that we are in the midst of a rental crisis in Ireland. It has come to a stage where employers are offering their staff incentives to help them cope with the shortage of rental properties and the rising rents. Some employers offer […]

The Passing On Of A Business

I am considering selling my business or passing on to the next generation or some form of exit strategy from my business – What tax issues do I need to bear in mind? I am a business man in my 50’s. I have owned my business for many years and am now considering my options. […]

What are the Company Law Implications of Brexit?

As the UK is set to leave the EU on the 29th March 2019 Irish companies which only have UK resident directors will be required to have a least one EEA resident director ( Section 137 Companies Act 2014) otherwise the companies will be in breach of the Companies Act. If it is impossible for an […]

DOES YOUR LIQUOR LICENCE FIT YOUR BUSINESS MODEL????

A liquor licence is granted pursuant to the Licensing Acts and is authorised to the person named therein to sell intoxicating liquor in accordance with the terms of the license in a particular premises. A liquor licence may be held by an individual, a partnership or a company. It is imperative that you ensure the […]

Maternity Benefits

What is available to new mothers and fathers, and what are the tax issues? With the introduction of paid parental leave for the first time in Budget 2019, now is a good time to recap on parents’ entitlements and potential tax issues associated with those entitlements. • The basic maternity leave entitlement for mothers is […]

A Tax Tip for each of the 12 Days of Christmas

With the festive season approaching, putting thought into tax issues may not be on many Santa lists. However, there may be several tax saving ideas that you are missing out on this Christmas. The following is a list of ideas that you may consider implementing before the year end, and which may be of some […]

Beneficial Ownership Register

Article 30 of the 4th EU Anti-Money Laundering Directive (4AMLD) requires all EU Member States to put into national law provisions around beneficial ownership information for corporate and legal entities. There are two stages to this process: 1) As of 15th November 2016 corporate and legal entities must hold adequate, accurate and current information on […]

Tracker mortgage redress for buy-to-let mortgages

Revenue has published a new Manual “Income tax implications for landlords with buy-to-let mortgages who have received tracker mortgage redress payments from banks”. The Manual confirms that “any tax liability that impacted customers may incur as a result of the relevant issue or in respect of any redress, compensation or other payment made to impacted […]

Repair and Leasing Scheme Payments

Revenue has published new guidance which sets out the treatment of payments to landlords received under the Repair and Leasing scheme. The scheme, which was launched earlier this year, is an initiative of the Department of Housing, Planning and Local Government and was set up to bring vacant properties into social housing. It is aimed […]

Legal Entity of your Business

There are a number of issues you need to consider if you are thinking of starting a new business, one of these being the legal entity your business will take. There are three basic types of ownership and the structure you choose can have significant impact on how you are protected under the law and […]

Highlights of Taxation Measures in Budget 2019

USC The 2% band is increased by €502 to €19,874, i.e. income from €12,012 to €19,784 @ 2% The rate for the band €19,875 to €70,044 is reduced from 4.75% to 4.5% Income Tax The standard rate band is increased by €750 to €35,300 for single people and to €44,400 for single income married couples […]

Audit Exemption

The Companies (Statutory Audits) Act 2018 was passed in July and commenced on 21st September 2018. It introduces a significant change to audit exemption where companies that file the annual return late will be allowed to file those particular financial statements as audit exempt and the company will be required to have the next two financial […]

PAYE Modernisation – Submitting a List of Employees

The deadline for submitting a “List of Employees” to Revenue is 31st October. This will enable Revenue to update and issue employee tax credits certificates and the employer copy (the Revenue Payroll Notification (RPN)) for 2019. The submitted list must include all employees (including directors). Employers who have a single Employer Registration (PREM number) but outsource […]

Airbnb Income

Revenue is writing to 12,000 individuals to remind them to include income from Airbnb lettings on their tax returns. The letters will also provide guidance on the tax treatment of this income and on how to correct returns already submitted, where necessary. Airbnb has provided Revenue with details of payments made to its customers in […]

Prepare For Brexit

A €5,000 Be Prepared Grant is available to existing Enterprise Ireland SME clients. The grant is intended to provide support to clients to use external resources to undertake a short assignment to determine how the company could respond to the threats and opportunities of Brexit. To apply visit www.prepareforbrexit.com/be-prepared-grant/.

Involuntary Company Strike-Off

Failure to file an annual return is one of the reasons a company may be involuntarily struck-off the register. A company is also at risk of strike-off under the following circumstances: where the company receives notice in writing from Revenue that the company has failed to deliver a statement (under section 882 Taxes Consolidation Act […]

Income Tax Return Deadline

The Income Tax Return Deadline 31st October is just a few weeks away. Well done to those who have filed their returns. If not it’s time to get working on your return for 2017. Any tax owed for 2017 and preliminary tax for 2018 must be paid by 31st October. Now is the time to […]

Renewal of Publican’s Licence

The National Excise Licence Office will send out renewal notices in early September. This renewal notice invites you to make your renewal application for 2018/19 and pay for your licence. All licensees require tax clearance and in certain cases a: Short Certificate of Incorporation Certificate of Registration of Business Name Revenue will automatically check your tax clearance status before issuing the licence.

PAYE modernisation – latest update on preparations

At a recent meeting on PAYE modernisation, Revenue noted that nearly 4,000 employers have uploaded their “List of Employees”. Revenue invited the first tranche of employers to upload their lists in July. The second and third tranches of employers will be invited to do so in August and September respectively. The purpose of this exercise […]

RCT Bulk Rate Review to check for outstanding returns

In early September, Revenue will carry out a Bulk Rate Review (BRR) of all subcontractors in the eRCT system. Paragraph 3.5 of Revenue’s Manual on Relevant Contracts Tax for Subcontractors sets out the criteria used to determine whether 0%, 20% or 35% RCT rate deduction applies. Outstanding tax returns or payments can result in an […]

Annual Returns – No More 14 Day ‘Extension’

As of the 1st April 2018, the Companies Registration Office (CRO) no longer use their discretion under Section 898 of the Companies Act 2014 to grant extensions (14 days) to the filing date of the annual return (B1). The following circumstances are examples of when the annual return will be refused by the CRO : […]

Tax Scams