Thursday, 23 March 2023

Latest Changes To BIK On A Company Car In Ireland 2023

The Irish government has introduced a tax relief of €10,000 to aid in reducing the amount of Benefit in Kind (BIK) payable on a company car in 2023. What Is Ben...

The Irish government has introduced a tax relief of €10,000 to aid in reducing the amount of Benefit in Kind (BIK) payable on a company car in 2023.

What Is Benefit in Kind (BIK)?

Benefits-in-kind (BIK) refer to non-cash rewards that an employer may give to their employees, in addition to their usual salary and benefits. These rewards, or benefits, can be in the form of additional annual leave, or training and development opportunities. They can also include tangible items such as company cars, mobile phones, laptops, and other technology items.

2023 Updates Relating to BIK on a Company Car:

The Irish government recently announced the approval of the Finance Bill 2023. Taxation measures have been put in place to support families and businesses that are or have been affected by the high energy crisis and cost of living challenges in Ireland. In addition to this, there has been a temporary change announced in relation to the Benefit in Kind system for vehicles.

Benefit in Kind (BIK) on company cars will be calculated with reference to a combination of CO2 emissions and business mileage from January 2023 onwards. The changes have been implemented as part of the government’s Climate Action Plan 2021 to lower emissions by 2030. They have been in effect since the 1st of January 2023, and they will be in place for subsequent years. However, a large number of employees with company cars in the usual emissions range have experienced a big increase in their income tax liabilities since the beginning of 2023. In a bid to address this, the Irish government has introduced a tax relief of €10,000, which will apply to the original market value of cars between categories A and D. This should aid in reducing the amount of BIK payable on a company car in 2023.

What This Means for Employers:

So, how much BIK is to be paid on company cars in 2023? When calculating BIK liability in 2023, employers can now reduce the original market value of company cars, vans and EVs by €10,000. When it comes to BIK on electric cars in Ireland, this €10,000 can be deducted in addition to the €35,000 pre-existing relief: bringing the total relief for 2023 to €45,000. The upper limit of business mileage has also been temporarily reduced by 4,000 km to 48,000.

These changes to BIK on company cars will remain in place from January 1st to December 31st, 2023.

Other Changes to BIK Rules on Company Cars from January 2023:

Before these changes, employees who had access to company vehicles by reason of employment (without a transfer of ownership), which were also available for private use, were chargeable to tax on the BIK. However, with the changes that have come into effect since January 2023, the BIK for the use of a company vehicle will be calculated based on the vehicle’s business mileage and CO2 emissions. It is also worth noting that the changes are effective for existing cars as well as new cars provided to employees. What does this mean for employees and employers? If a company vehicle belongs to a high CO2 emission bracket, costs are likely to increase.

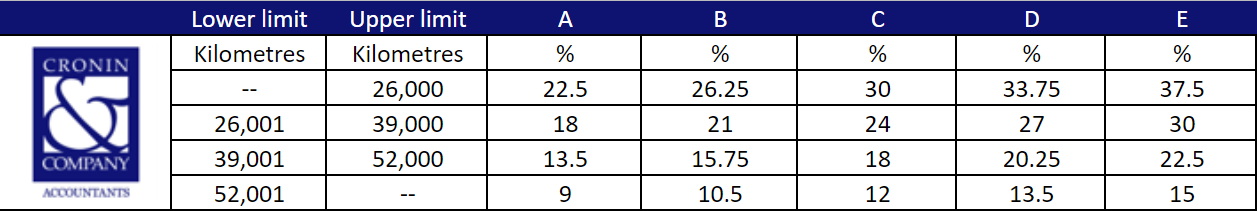

The business mileage and CO2 emission category: *52,000 upper limit temporarily reduced to 48,000.

*52,000 upper limit temporarily reduced to 48,000.

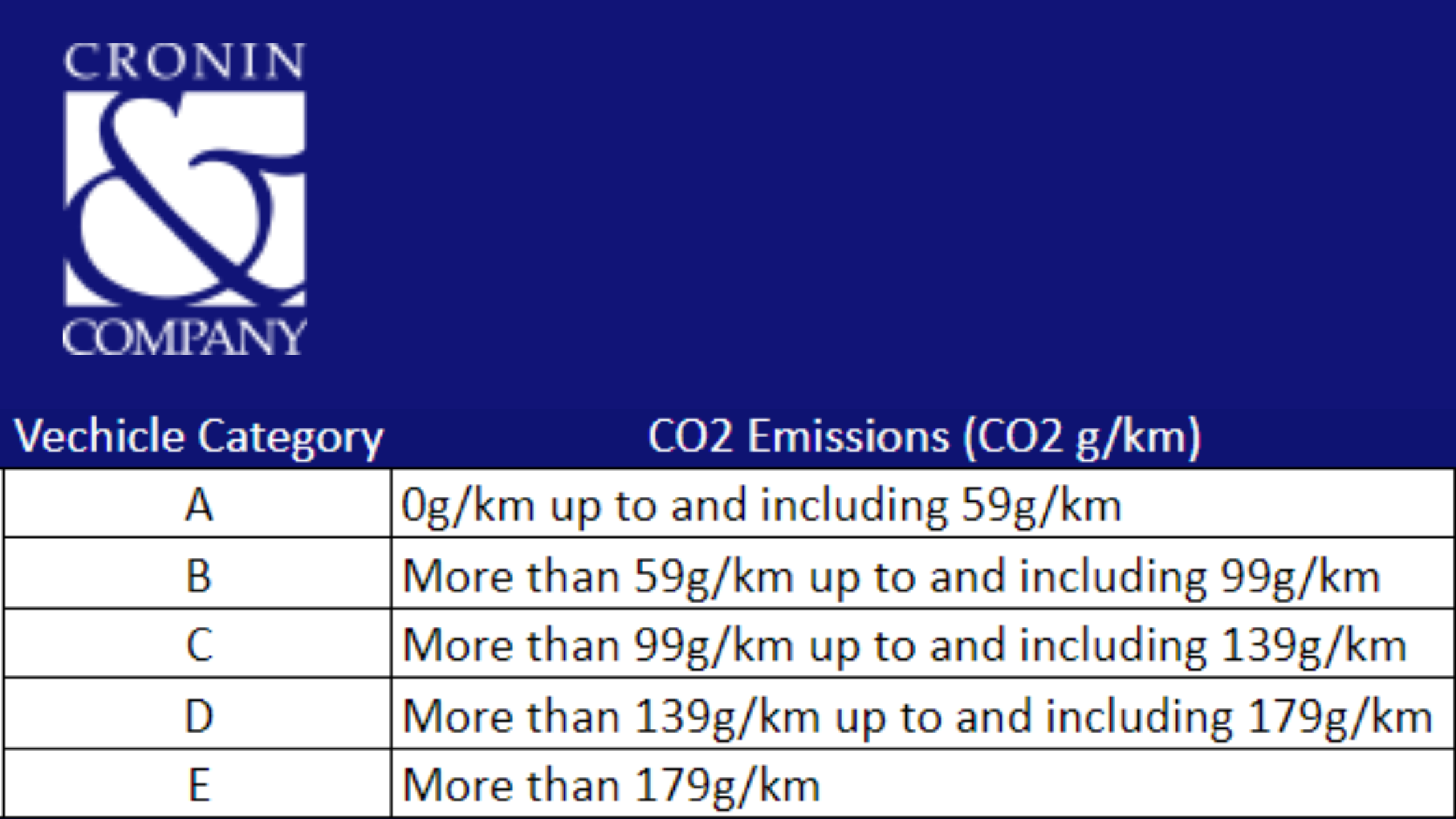

The CO2 emissions category of the vehicle is as below: Example: An employee has a company car on the 1st of January 2023. The OMV (open market value) of the company car is €20,000. Due to the new tax relief, the OMV of the car can be reduced by a further €10,000, bringing the value of the car to €10,000. The car produces 85g/km in CO₂ emissions, putting the company car into Category B. The kilometres in the year were 38,000. Going by the charts above, the BIK is equal to €10,000 (OMV) x 21% (% for CO2 emissions category B vehicles that have business mileage between 26,001 and 39,000 kilometres). The BIK calculation according to new changes would be €10,000 x 21% = €2,100.

Example: An employee has a company car on the 1st of January 2023. The OMV (open market value) of the company car is €20,000. Due to the new tax relief, the OMV of the car can be reduced by a further €10,000, bringing the value of the car to €10,000. The car produces 85g/km in CO₂ emissions, putting the company car into Category B. The kilometres in the year were 38,000. Going by the charts above, the BIK is equal to €10,000 (OMV) x 21% (% for CO2 emissions category B vehicles that have business mileage between 26,001 and 39,000 kilometres). The BIK calculation according to new changes would be €10,000 x 21% = €2,100.

Benefit-in-kind: Effect on Electric Vehicles from 1 January 2023

The Department of Finance announced in Budget 2022 the phasing out of the 0% BIK on Electric Vehicles over the next 4 years. Finance Act 2021 extended the favourable BIK regime for certain electric vehicles made available to employees in the period from the 1st of January 2023 to the 31st of December 2025. The relief from the BIK charge arising during this period applies on a tapered basis.

For an electric vehicle made available for an employee’s private use during the years 2023 – 2025, the cash equivalent will be calculated based on the actual original market value (OMV) of the vehicle reduced by:

- €45,000 (original 35,000 + 10,000 relief) in respect of vehicles made available in the 2023 year of assessment;

- €20,000 in respect of vehicles made available in the 2024 year of assessment; and

- €10,000 in respect of vehicles made available in the 2025 year of assessment.

If the reduction reduces the OMV to Nil, a BIK charge will not arise. Any portion of OMV remaining, after the reduction is applied, is chargeable to benefit-in-kind at the prescribed rates. Even with these changes in place, companies are still encouraged through BiK to opt for electric vehicles and the cheaper car insurance or van insurance in Ireland for these is also an incentive. Due to multiple factors such as driver profile, usage patterns, advanced safety features, lower accident rates, frequency of repairs or environmental incentives, electric car insurance is generally cheaper.

Benefit-in-Kind: Effect on Vans from 1 January 2023

Section 6 of the Finance Act 2019 also introduced a change to the percentage used in the calculation of the cash equivalent of the use of a van. From 1 January 2023, the percentage used in the calculation of the cash equivalent of the use of a van will increase from 5% to 8%. The €10,000 reduction in OMV also applies for 2023. Employers should make their staff aware of the new BIK rules. Employers who provide company vehicles to their employees should also review their vehicle’s CO2 emission category to determine the cost increase considering these changes. Depending on which band the company’s vehicles fall into, employers may need to consider switching to vehicles with lower emissions, like electric vehicles. According to the Climate Action Plan 2021, Ireland plans to have 945,000 electric vehicles in the Irish fleet by 2030, and there are grants available to make it more affordable for the general public, taxi drivers and companies to switch to electric vehicles.

For more information about changes to Benefit-In-Kind (BIK) rules on company cars in 2023, get in contact with a member of the team at our accountancy firm today. Our expertise extend to taxation services, payroll & bookeeping services, company secretarial, business advisory and audit and assurance.