Thursday, 8 August 2024

Determining Employment Status for Tax Purposes: The Karshan Case

At Cronin & Company, a trusted accountancy firm in Dublin , we understand the complexities involved in determining employment status for tax purposes. On 21...

At Cronin & Company, a trusted accountancy firm in Dublin, we understand the complexities involved in determining employment status for tax purposes. On 21 May 2024, Revenue issued new guidance following the Supreme Court judgement in 'The Revenue Commissioners v Karshan (Midlands) Ltd. t/a Domino’s Pizza’ (‘Karshan case’). This case focused on the tax treatment of delivery drivers classified as self-employed contractors. This article summarises the key points from the new guidance, providing insights that employers should consider when determining employment status and if an arrangement is a contract of service (employment) or a contract for service (self-employed). In other words, whether they are employed vs self-employed. This article focuses on the tax implications of such engagements and does not cover broader employment rights or PRSI classifications. It serves as a non-exhaustive summary for guidance purposes and should not be considered tax advice. For comprehensive tax and legal advice, it's crucial to consult with professionals like our tax team at Cronin & Co.

Overview

The judgement in the Karshan case restated the position that the terms and conditions in a written contract should be considered when determining the status of the relationship, however, they should not be the sole determining factors to consider. Employers should consider the facts and circumstances of the actual relationship in determining the employment status of an arrangement.

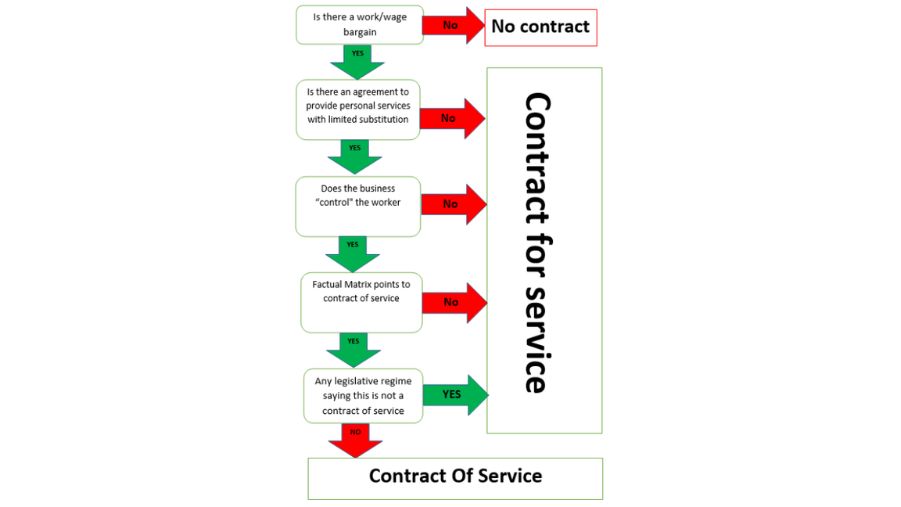

The judgement set out a 5-question decision-making framework to assist with determining the employment status of a relationship. It also clarified that there does not need to be a continuity of service and that an individual engaged to carry out one job, gig or shift would generally be an employee for tax purposes for that one job, gig or shift. Revenue in their guidance has confirmed the following:

“It is open to any worker to incorporate their business, at which point the business is a separate legal entity. Any engagement of companies by businesses cannot be contracts of service, or employments, for taxation purposes. 5 This judgment does not disturb this position”.

5-Question Decision Making Framework

- Does the contract involve the exchange or wage or other remuneration for work? – ‘Work/Wage Bargain’.

- If so, is the individual agreeing to provide their own services, and not those of a third party, to the employer? – ‘Personal Service’.

- If so, does the employer exercise sufficient control over the individual to render the agreement capable of being an employment agreement? – ‘Control’.

- If the 3 requirements at 1-3 above are met, the employer should review “all the circumstances of the employment”.

- Finally, is there anything in the legislation that would supplement or adjust the decisions made at 1-4 above.

The first 3 questions are to be viewed as a filter. If any of these are not applicable, then a contract of employment cannot exist. If 1-3 are all applicable, then questions 4 and 5 are considered.

1 – Work/Wage Bargain

- Is there an exchange of work for remuneration? The judgement maintained the position that there must be a wage or other consideration for an employment contract to exist:

“The phrase [Mutuality of Obligation] should be viewed as doing no more than describing the consideration that has to be present before a working arrangement is capable of being categorised as an employment contract.”

- The judgement further set out that an employment contract may consist of a regular wage-for-work bargain, a series of agreements relating to several tasks, an agreement to complete one task, an agreement defined by an umbrella contract or a combination of all of the above.

- It is also clear that where there is continuous employment it can suggest an employment contract is in place, but it is not an essential condition.

- The Revenue guidance further sets out the following summary:

“In summary, provided there is payment by a business to a worker for a service, whether agreed in writing or not, and whether the work is carried out on a once-off basis, or continuously, or anything in between, there is a contract which is capable of being an employment contract.”

2 - Personal Service

- Also known as the ‘substitute test’. Can the individual engage someone else to complete the work (sub-contract or an assistant), or are they required to do it themselves?

- If there are numerous restrictions on a “substitute” such as only being allowed if the individual is unable to complete the work, or if the employer has to give consent for a substitute would usually be consistent with personal service.

- If the only restriction is that the substitute must be shown to be competent/qualified to do the job, this would not be consistent with personal service.

- A typical characteristic of an independent contractor or self-employed individual is that they are free to hire other people on his/her own terms to complete the job that has been agreed.

- The Revenue guidance further sets out the following summary:

“In summary, the more restrictions imposed on the freedom for a worker to appoint a substitute, the more indicative the arrangement is that of a contract of employment. The types of restrictions that may occur which indicate an employment status relationship will be arrangements where prior approval of substitutes is required such that the business has an unfettered right of refusal, payment of substitutes is made directly by the business rather than the person they are providing cover for, or where substitutes are from a pool of preapproved workers.”

3 – Control

- Control refers to the ability, authority, or right of a business to exercise control over a worker concerning what should be done, how it should be done, when it should be done and where it should be done.

- It is not necessary that the control has to be exercised, but the ability to control is enough. For example, a skilled worker will likely know how to do a particular piece of work and what needs to be done to achieve it without direction, but if the employer ultimately can tell them how and what needs to be done, this will exhibit an element of control.

- The judgement also confirms that a minimum level of control is required before a contract can be capable of being deemed an employment contract:

“…if the putative employer does not enjoy the power to direct the type of work the worker is required to do, the relationship will not be capable of constituting an employment relationship (Minister for Education v. The Labour Court and ors. at para. 9.13, and para. 102 of the reported judgment). Similarly, if the service is provided to a person who has no entitlement to prescribe times by which the work is to be done, no power to determine where or in what conditions the work is to be done or, within an enterprise, the persons who were to do particular work, it is difficult to see how this requirement could be met.”

- Additional matters to consider when examining control include elements such as notice periods, annual leave entitlements, whether and to what extent the business controls the method and amount of payment, and the working hours of the worker.

4 – All the Circumstances of the employment

- If the first 3 tests are applicable, consideration then needs to be given to all the facts of the engagement to determine if they are consistent with an employment contract.

- Every case depends on the specific facts of that case, and no two cases are likely to be identical.

- The judgement went on to expand on 4 specific matters to be considered at this stage:

-

- The contract itself must be interpreted in the light of the factual matrix in which it was concluded.

- You must take into account the actual dealings of the parties, i.e. how the work was done, the facts or realities of the situation on the ground, and what the real arrangement on a day-to-day basis was. The fact that an agreement says one thing when both parties intend another will not be given effect under the “doctrine of sham, or perhaps mistake”. While a detailed written agreement can be significant, efforts to describe an arrangement in a way that is different to reality to avoid an employment status will be challenged.

- This part of the review cannot depend on any assumptions. The onus of proof will be on the employer who asserts that a particular arrangement is not an employment contract.

- If it is not an employment contract, it must be something else, i.e. sub-contract, partnership, licence agreement etc.

- After reviewing all the facts, consideration should be given as to whether the individual is providing services on his/her own account or whether the facts indicate that they are providing the services on behalf of the business.

5 – Legislative context

- It is important to review if there is any legislation that requires an adjustment or supplement to any of the foregoing questions in the circumstances of the relationship being considered.

The Revenue guidance also provides a “Decision Tree” to help with the decision-making process of determining employment status. See below:

In light of the Karshan case and the new Revenue guidance, it's essential for businesses to carefully review their current and future contractor arrangements to determine the appropriate employment status. The five-question decision-making framework provides a structured approach to this process. Given the complexities involved, consulting with a reputable accountancy firm in Dublin, like Cronin & Co., can help ensure compliance and avoid potential tax issues. We will not be responsible for any loss or liability arising from decisions based on this article.