Insights

What is a chart of accounts? It is a structured listing of all the financial accounts used by a business to record transactions and organise its finances. A well-designed chart of accounts supports clear financial reporting. It also helps ensure tax compliance and informed decision-making. For businesses in Ireland, this tool is a foundational element of accurate financial management. It is a key area where professional bookkeeping services bring added value.

Why a Chart of Accounts Matters

A chart of accounts in Ireland ensures that every transaction is recorded in the appropriate category. This makes it easier to track income, expenses, assets, liabilities, and equity. It is the backbone of your financial system. It helps business owners and accountants maintain clarity and accuracy in reporting.

When properly structured, it enables consistency across reporting periods. It also supports alignment with regulatory requirements, including those issued by Revenue. Whether for internal reporting or compliance, this structure helps businesses stay organised.

What is a Chart of Accounts: How it Works

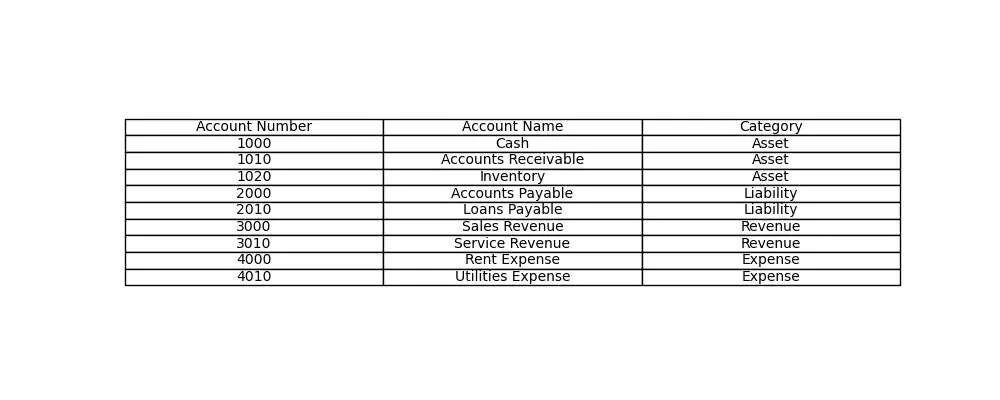

Typically, the chart is divided into several primary categories:

- Assets (e.g., cash, accounts receivable, inventory)

- Liabilities (e.g., loans, accounts payable)

- Equity (e.g., retained earnings)

- Income (e.g., sales, other revenue)

- Expenses (e.g., rent, salaries, utilities)

Each account is assigned a unique code or number, making entries easily traceable. This structure helps ensure accurate reporting and simplifies audits or reviews.

Tailored for Your Business

What is a chart of accounts for a construction company? It might include project-specific cost tracking, subcontractor payments, and equipment leasing accounts. Meanwhile, a non-profit chart of accounts would consist of grants, donations, and restricted fund tracking. This structure helps support transparency and compliance.

For industry-specific needs, consider these additional examples:

- A chart of accounts for a construction company may break down material costs, labour, project revenue, and retentions.

- Chart of accounts examples can vary widely depending on the size and complexity of the business. However, the structure remains fundamentally the same.

- A chart of accounts for a restaurant might include food and beverage sales, cost of goods sold, supplier invoices, and tips or gratuities. Here’s an example:

Local Context: Chart of Accounts in Ireland

A well-structured chart of accounts should align with Irish financial reporting standards and tax obligations. Accurate categorisation aids with VAT reporting. It is essential for preparing end-of-year financial statements. Both VAT reporting and financial statements are key areas of focus for Revenue audits. It also enables better cash flow management and strategic planning for growing businesses.

What is a chart of accounts? It is more than just a list of financial categories. It’s a strategic tool that provides clarity, supports compliance, and enables better decision-making. Every Irish business, regardless of size or sector, benefits from a clearly defined chart of accounts. Maintaining it properly supports accuracy and control.

At Cronin & Company, our bookkeeping services are designed to support your financial accuracy. We help you set up, review, and manage your accounts, ensuring it meets the specific needs of your business.

Contact us to learn how we can help structure your finances for compliance and long-term success.