News & Events

When considering a job offer or evaluating your financial situation, understanding your take-home pay is crucial. Knowing the average take-home pay in Ireland can provide valuable insights into your financial planning. This blog aims to explore the concept of average take-home pay in Ireland, providing an overview of calculations, factors influencing net income, and how you can estimate your own take-home pay. As one of the top accountancy firms in Dublin in Ireland, we are here to help you navigate this important aspect of your finances.

What Is the Average Take-Home Salary in Ireland?

The average salary in Ireland serves as a benchmark for understanding the earning potential and economic landscape. According to the Central Statistics Office (Q4 2022), the national average (mean) salary in Ireland is €46,814. However, it is important to consider both the mean and median salary figures to better understand the income distribution. Remember, a small number of people with very high incomes can distort this figure. On that basis, the median salary is €40,579. So, the average take-home salary in Ireland (for the average person) is approximately €33,201.

Calculating Average Take-Home Pay in Ireland:

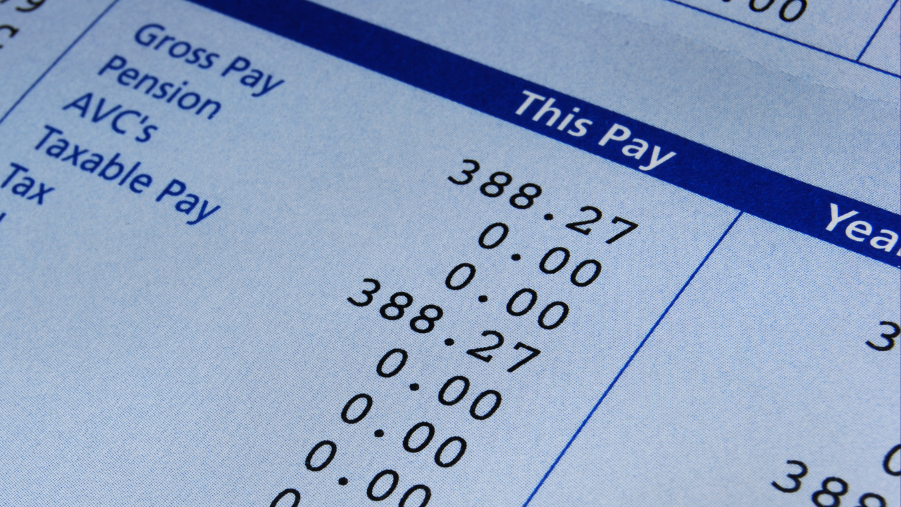

Determining your average take-home pay in Ireland requires consideration of several factors, including gross salary, income tax, PRSI (Pay Related Social Insurance) contributions, USC (Universal Social Charge), and any other applicable deductions. While it may seem complex, online salary calculators can simplify this process. One such reliable tool is the Salary After Tax calculator, which provides accurate estimates of your net income. You can access the salary after-tax calculator here to calculate your own take-home pay.

Factors Influencing Net Income:

In Ireland, several factors can affect your net income and subsequently impact your average take-home pay. The most significant factors include your gross salary, tax credits, tax bands, PRSI contributions, and USC rates. It is essential to understand how these elements interact to determine your final net income. By staying informed about the latest tax rates and thresholds, you can make informed decisions regarding your financial goals and budgeting.

If you’re a sole trader or business owner, looking for help with taxation planning, we can provide a range of comprehensive taxation services to assist you.

Regional variations significantly impact average salaries in Ireland. For example, in Dublin, where living costs are high and there is a demand for specialists, salaries tend to be higher compared to smaller and more affordable areas. It is important to consider the cost of living and job market dynamics in your specific location when estimating your take-home pay.

Estimating Your Take-Home Pay:

To estimate your take-home pay, start with your gross salary—the total amount earned before deductions. Use the Salary After Tax calculator, enter your gross salary, any applicable tax credits, and other necessary details. The calculator will generate an estimate of your net income, providing valuable insights into your take-home pay. Keep in mind that the actual calculations may vary based on your specific circumstances and any additional deductions.

Planning Your Finances:

Understanding your average take-home pay is crucial for effective financial planning in Ireland. It allows you to budget for living expenses, savings, investments, and other financial goals. By assessing your net income, you can make informed decisions regarding housing, transportation, healthcare, education, and other aspects of your financial life.

At Cronin & Co, we are committed to helping individuals and businesses navigate their financial responsibilities. Visit our website to learn more about our services and how we can support your financial needs.

Powered by Everbold Digital Marketing Agency | Ireland