Uncategorized

A pension is a long-term savings plan with tax relief helping to prepare a person for retirement. When you pay your pension contribution it is tax deductible meaning that you save a certain percentage of tax on your income depending on your age and the pension contribution made. Income Tax relief is given at your marginal (highest) tax rate. With your pension you are building up income for your future retirement and minimising your current tax bills when you make pension contributions.

Income Tax relief is available against earnings from your employment for your pension contributions made. Relief is available against Income Tax for self-employed individuals and PAYE for employees (salary-based income). Relief is not available against USC or PRSI.

Income Tax relief is available for pension contributions in any of the following plans.

· Occupational pension schemes

· Personal retirement saving accounts (PRSAs)

· Retirement annuity contracts (RACs)

· Qualifying overseas plans

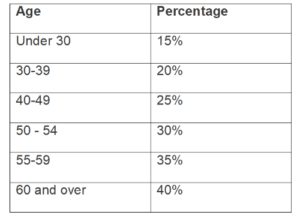

How much you can contribute to your pension is based on 2 factors, being age and income. Below is the amount you can contribute to your pension based on your age bracket.

The maximum amount of earnings considered for calculating tax relief is €115,000 per year. If you make contributions, but do not get tax relief on them because you exceed the tax relief limits, you can apply for tax relief on these contributions in the future.

If you have more than one source of income, relief is only allowable on the source of income the pension contributions are made from.

Cronin and Co is an accountancy firm based in Dublin. For Taxation, Business Advisory, Bookkeeping, and Payroll services please get in touch.